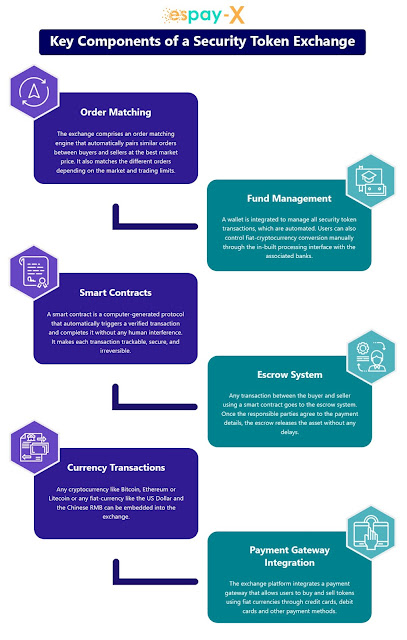

Order Matching

The exchange comprises an order matching engine that automatically pairs similar orders between buyers and sellers at the best market price. It also matches the different orders depending on the market and trading limits.

Fund Management

A wallet is integrated to manage all security token transactions, which are automated. Users can also control fiat-cryptocurrency conversion manually through the in-built processing interface with the associated banks.

Smart Contracts

A smart contract is a computer-generated protocol that automatically triggers a verified transaction and completes it without any human interference. It makes each transaction trackable, secure, and irreversible.

Escrow System

Any transaction between the buyer and seller using a smart contract goes to the escrow system. Once the responsible parties agree to the payment details, the escrow releases the asset without any delays.

Currency Transactions

Any cryptocurrency like Bitcoin, Ethereum or Litecoin or any fiat-currency like the US Dollar and the Chinese RMB can be embedded into the exchange.

Payment Gateway Integration

The exchange platform integrates a payment gateway that allows users to buy and sell tokens using fiat currencies through credit cards, debit cards and other payment methods.

This is a small section from our extensive market report on security token exchanges (STE). If you would like to get complete hold over the nuances of this market with the present and future predictions, the key players, and how to build your own security token exchange, click here for the full research report.

No comments:

Post a Comment